are salt taxes deductible in 2020

Since the 10000 federal income tax deduction limit for SALT was implemented by the Tax Cuts and Jobs Act several states including Connecticut Louisiana Maryland New. IRS Approves SALT Workaround for Pass-Through Entity Notice 2020-75.

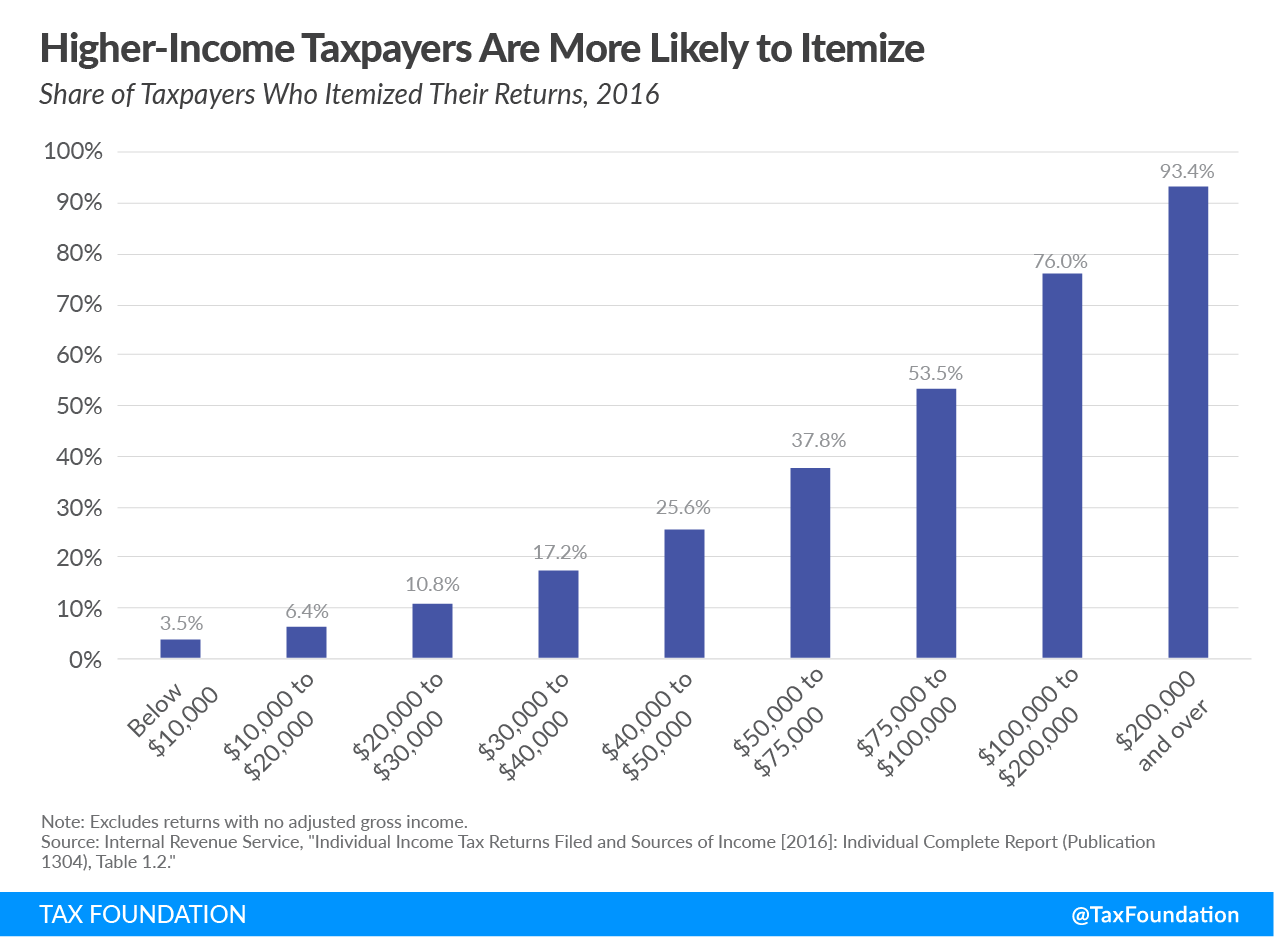

What Are Itemized Deductions And Who Claims Them Tax Policy Center

The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns.

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

. 9 2020 the Internal Revenue Service issued Notice 2020-75. If you dont itemize and instead claim the standard deduction which is 12200 for 2019 and 12400 for 2020 you cant claim any of the state and local tax deductions. The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers.

164a provides that the SALT deduction. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. In proposed regulations released this week the Department of the Treasury and the Internal Revenue Service IRS have signaled their intention to bless one type of state workaround for the 10000 State and Local Tax SALT deduction cap.

Using their 22 percent tax. The IRS released guidance on Nov. 2 days agoThe United States federal state and local tax SALT deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income.

There is talk that the SALT deduction limit will be increased from 10000 to 70000 as part of the Build Back Better Plan - this bill has not been signed into law. A taxpayer not subject to the alternative minimum taxand therefore able to take SALT deductionswho used to pay 100000 in state taxes could enjoy 100000 in federal tax deductions as a result. For one thing the law effectively doubled the standard deductionfrom 6000 to 12000 for single filers and 12000 to 24000 for joint.

A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same line as the 2020 amount greater than 10000. However that technique involving shifting the tax to a pass-through entity such as a partnership or S. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025.

Prior to the limits enactment the cost in lost revenue for the federal government for the SALT deduction was estimated at 78 billion and. The SALT deduction reduces the cost of. 52132 less the excess taxes leaves you with 42087 in itemized deductions.

Improving Lives Through Smart Tax Policy. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status. The net cost of state taxes was only 76000 as a result 100000 paid to the state minus 24000 in federal income tax savings.

9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state laws that shift the tax burden from individual owners to the business entityThe guidance clarifies uncertainty on the issue and supports partnerships and S corporations deducting tax payments. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. The IRS released Notice 2020-75 on November 9 2020 which effectively allows state and local tax SALT workaround deductions for individual owners of pass-through entities PTEs.

IR-2020-252 Before TCJA individual taxpayers normally could deduct all state and local taxes SALT as itemized deductions. While this taxpayer paid 13000 of eligible state and local taxes current law only allows them to deduct 10000. For the first time the notice approves of one of the techniques that states have used to help taxpayers avoid the 10000 cap on the deduction of state and local taxes.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. Using Schedule A is commonly referred to as itemizing deductions. TCJA limited the individual SALT deduction to 10000 for taxable years 2018 through 2025.

The Tax Cuts and Jobs Act of 2017 put a 10000 cap on the SALT deduction for the years 20182026. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

Entity-level taxes that allow owners of pass-through businesses to pay an. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. Notice 2020-75 Section 3022.

The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040. That excess of 10329 is showing for 2020. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. In a welcome notice Notice 2020-75 released on November 9 2020 the IRS announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and paid by a partnership or an S corporation ie pass-through entities or PTEs on its income are allowed as a deduction by the PTE in computing its non. Some states have been looking for a workaround to enable.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Tax Deductions Lower Taxes And Tax Liability Higher Refund

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

Itemized Deduction Who Benefits From Itemized Deductions

Tax Deduction Definition Taxedu Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

What Is The Salt Deduction H R Block

Standard Itemized Tax Deductions For The 2022 Tax Year Don T Mess With Taxes

What Are Itemized Deductions And Who Claims Them Tax Policy Center

3 Itemized Deduction Changes With Tax Reform H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New Limits On State And Local Tax Deductions Williams Keepers Llc

What Is The Salt Deduction H R Block

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth